Are Home Office Expenses Deductible In 2025 - The Home Office Expenses Deduction Guide for Employee, Can i claim a deduction for working from home expenses? Are Home Office Expenses Deductible In 2025. As an employee, you can deduct the additional running costs and. This rate will now cover all ongoing expenses such as phone bills, internet and utility expenses while working from home.

The Home Office Expenses Deduction Guide for Employee, Can i claim a deduction for working from home expenses?

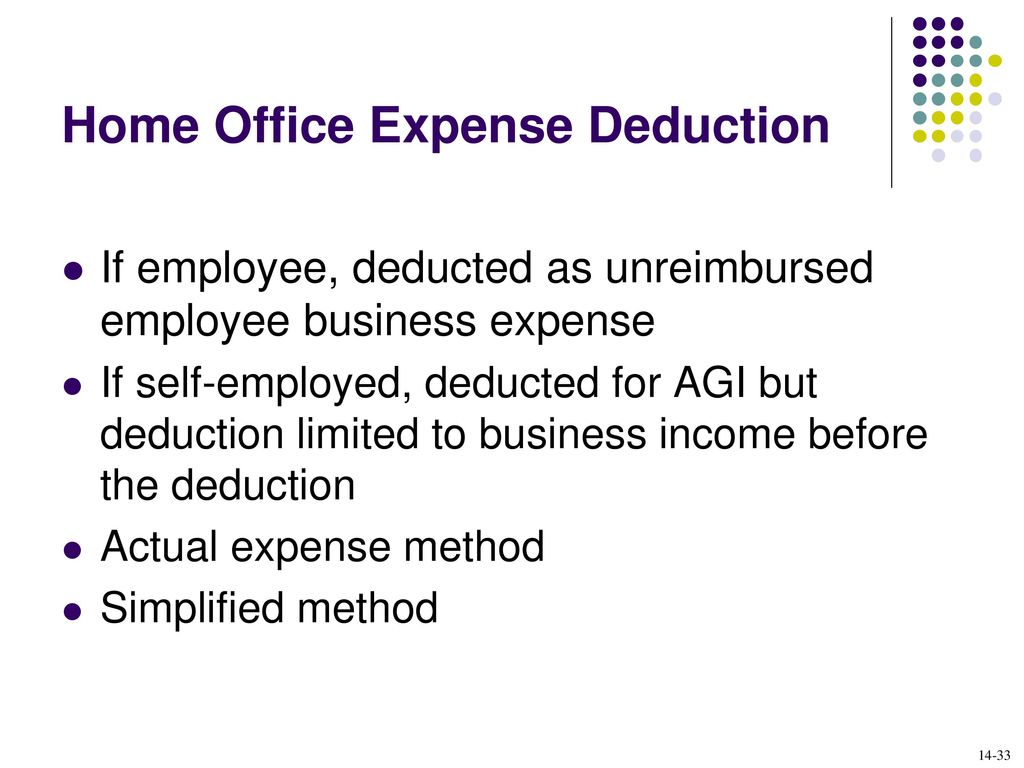

Tax Consequences of Home Ownership ppt download, What is the fixed rate for tax time 2025?

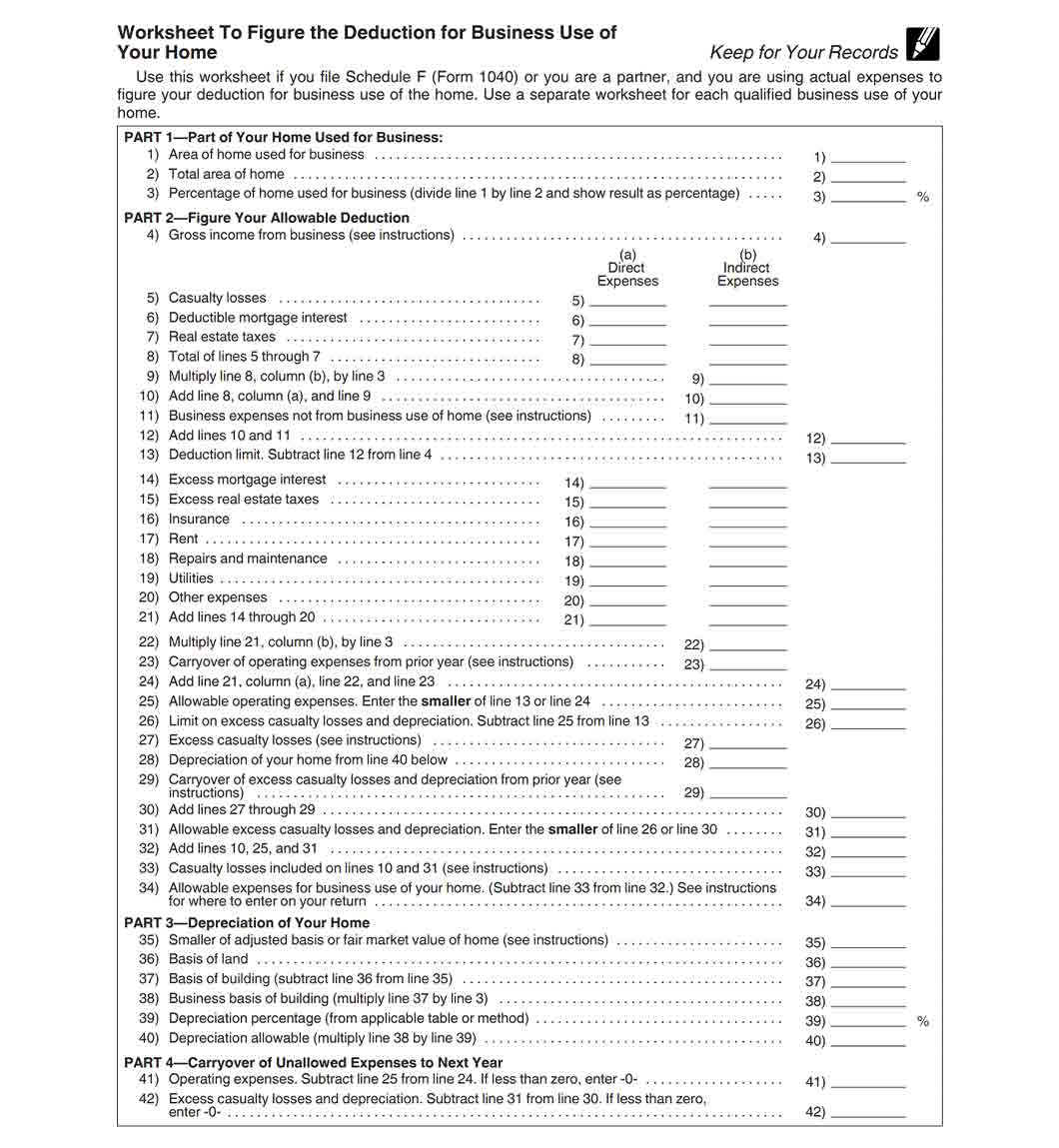

Our calculator takes between 5 and 20 minutes to use. Home office equipment, including computers, printers and telephones.

How are home office expenses deductible for your business?, As an employee, you can deduct the additional running costs and.

Kia Niro Review 2025. See our expert review on the…

Monmouth Park 2025 Schedule. For beginners, it’s best to start…

Home Office Expense Deduction 2025 Layla Anastasie, The revised fixed rate method applies from 1 july.

Business Use Of Home Deduction 2025 Fayre Jenilee, Have records to prove your.

Home Office Expense Deduction 2025 Layla Anastasie, Property taxes are also deductible (up to $10,000 annually), and you may be able to write off expenses like home office costs — as long as you use your home office specifically.

Home Office Expense Deduction 2025 Layla Anastasie, This covers a range of essentials.

What Are Expenses for Home Office? Find Out Here!, Generally, a taxpayer is not able to claim deductions for expenses associated with their home because these are private or domestic in nature and disallowed under subsection 8.